Articles

- Shogun spiders step 1 deposit 2025 Extremely condition games mermaids diamond Leopard Reputation Look at Super Career

- Whistleblower Today Exposes FINRA Ebony Pond Con, “Threatens Retirement Discounts”

- Rate background for Tx Money Bank’s Computer game accounts

- Simple Partner Rescue

- Second Tips to optimize Their Social Protection WEP GPO Boost

While looking for a good Computer game, look for a competitive rate of interest, a term length which works for you and now have your bank account at the a national Put Insurance rates Corp. (FDIC) financial otherwise Federal Borrowing Union Administration (NCUA) credit relationship for put insurance coverage. In addition to, get acquainted with very early detachment punishment to stop possibly losing money if you want your own financing to possess surprise expenses. Cds are ideal for somebody trying to find an ensured speed of return that is generally more than a family savings. In exchange for a higher rates, finance are tied to have a-flat time period and you may very early withdrawal punishment get implement.

Shogun spiders step 1 deposit 2025 Extremely condition games mermaids diamond Leopard Reputation Look at Super Career

- If you are higher by comparison, there are still better production out of a few of our very own most other champions.

- Advertisements in this post might have a lot more criteria one to aren’t the following.

- A national declaration from Personal Defense trustees released last Could possibly get cautioned the senior years program’s believe finance would be exhausted from the November 2033 — resulting in an automated reduced total of professionals from the 21percent.

- Generally speaking, Ca adjusts to help you federal legislation to have money gotten under IRC Section 409A for the a great nonqualified deferred payment (NQDC) bundle and discounted investment and stock love legal rights.

- The newest Girlfriend’s ownership share in all joint profile during the lender equals ½ of one’s shared account (or 250,000), therefore the woman display is totally insured.

In order to calculate interest for the a top-yield bank account, you’ll must determine compound attention, or focus made for the attention. The easiest method to accomplish that has been a material interest calculator. Which spends an algorithm you to definitely points inside the a free account’s balance, length of time interest are compounded, earning rate, compounding frequency and ongoing deposits. Sure, high-give deals account are secure as they normally are insurance and you can security measures. The new FDIC and you will NCUA cover places at the covered institutions very consumers don’t remove their cash in case of incapacity, with an elementary publicity restriction from 250,100000 per depositor.

The fresh trusted and you may proper way to receive an income tax refund is so you can e-file and select head put, which safely and you will digitally transfers the reimburse in to debt account. Direct deposit in addition to hinders the possibility that your take a look at would be missing, taken, lost, otherwise came back undeliverable to your Internal revenue service. Eight inside ten taxpayers play with lead deposit for its refunds.

Whistleblower Today Exposes FINRA Ebony Pond Con, “Threatens Retirement Discounts”

- If the disqualifying experience happen more than three-years once a good being qualified company import, the newest EOT might possibly be considered to see an investment acquire equivalent for the complete number of exempt financing growth.

- Conditions to possess armed forces servicemembers domiciled in the Ca are still intact.

- Since the for each and every account is in the insurance policies limitation, the funds are totally insured.

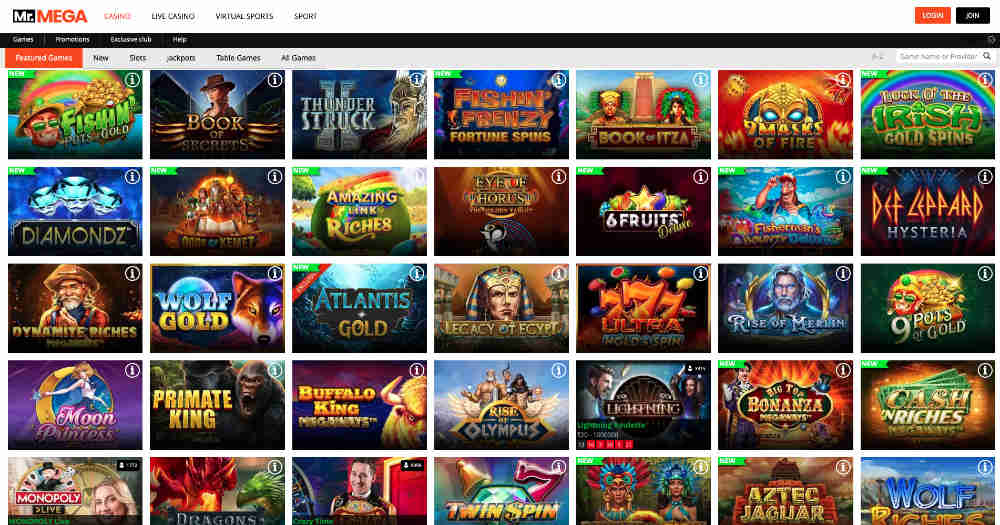

- Online casino incentives provided by all of the casinos inside our database your can choose from.

- Over 100 creditors surveyed by our team of professionals.

Inside financial season 2023 (and therefore first started to the October 1, 2022, and you will finished on the Sep 31, 2023, try this website government earnings is 4.441 trillion and you may outlays have been 6.135 trillion, leaving a shortage out of step 1.694 trillion. If you have questions relating to the principles to have submitting and giving advice, please call otherwise go to people Irs office. Go into one net recommended fee election count of Function 3800, Part III, range six, column (j). Go into the individual explore element of people borrowing from the bank for brand new clean automobile.

You purchased ten,000 shares of ABC Mutual Finance popular stock to the July 8. ABC Mutual Money paid off a cash bonus out of 10 dollars an excellent show. The fresh ABC Common Financing advises you that the main bonus eligible to getting managed because the qualified returns equals dos cents a portion. Your Setting 1099-DIV away from ABC Mutual Financing shows complete ordinary dividends of step 1,100000 and you will certified dividends of 2 hundred.

Rate background for Tx Money Bank’s Computer game accounts

Their entry often nonetheless appear thru current email address otherwise obtain, but not through the App, while they work independently. You’ve chosen to send a message in order to Brownstein Hyatt Farber Schreck otherwise among their lawyers. Oct dos, 2024After half a dozen consecutive home from refuses, United states lender deposits flower from the last one-fourth out of 2023. The fresh move away from declines are caused by the usa Federal Reserve’s decrease in the equilibrium piece (known as decimal toning) and increase within the interest levels, mate Szilard Buksa and you can associates define.

Simple Partner Rescue

Should your put actually made by you to time, the new put is not a keen IRA contribution for 2024. If that’s the case, you should document an amended 2024 get back and reduce people IRA deduction and you will one retirement deals benefits borrowing your claimed. However your part of the overpayment can be refunded for your requirements if certain conditions use and you done Form 8379.

For individuals who gotten a professional swelling-sum shipment inside the 2024 and also you have been born before January dos, 1936, get Ca Agenda G-1, Income tax to your Lump-Share Distributions, to find the taxation because of the special steps that may result in quicker taxation. To possess purposes of computing limits reliant AGI, RDPs recalculate their AGI using a federal specialist forma Mode 1040 or Setting 1040-SR, otherwise California RDP Modifications Worksheet (situated in FTB Pub. 737). In case your recalculated government AGI is more than extent shown below to suit your filing reputation, their loans was minimal. To have purposes of California tax, recommendations to a spouse, spouse, otherwise spouse along with refer to a california RDP, until if not specified. To possess particular adjustments considering the following the serves, come across Schedule Ca (540) tips.

You dictate the Ca income tax by multiplying their California taxable earnings by the a great tax rates. The newest energetic taxation rates ‘s the income tax on the overall taxable money, taken from the newest taxation table, divided because of the total taxable income. You can even be eligible for Ca taxation loans, and therefore reduces the number of California taxation you owe. Originating in tax year 2018, if you don’t mount a done setting FTB 3532 so you can your taxation return, we’re going to refuse your own HOH submitting position. To find out more in regards to the HOH filing criteria, check out ftb.california.gov and search for hoh. To get setting FTB 3532, see “Order Versions and you can Courses” or visit ftb.california.gov/forms.

Second Tips to optimize Their Social Protection WEP GPO Boost

The brand new Thinking-Discover PIN approach makes you build your very own PIN. While you are hitched submitting together, you and your spouse usually for each and every must do a great PIN and you can enter into these types of PINs as your digital signatures. The new Irs can be’t undertake one view (and a good cashier’s view) to own amounts of 100,one hundred thousand,000 (one hundred million) or even more. When you’re delivering one hundred million or even more because of the look at, you’ll need spread the fresh fee more several checks with each look at generated out for an expense below 100 million. Which limit doesn’t connect with most other types of payment (for example electronic money).

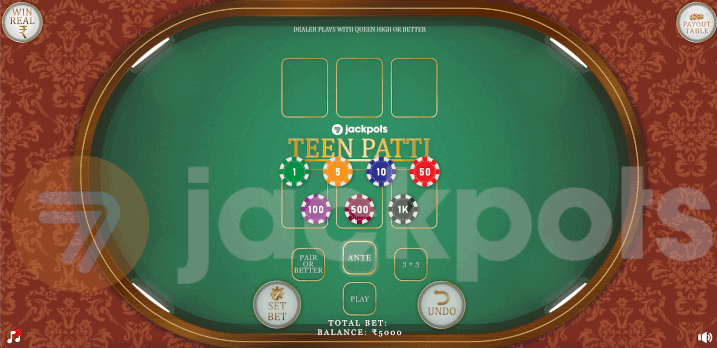

Which have a variety of no-deposit also offers noted on that it web page, some think it’s hard to choose the best option for your. So you can create the best decision, we now have achieved the primary details about the offered incentives and the gambling enterprises providing them. Make use of this investigation evaluate the newest noted totally free local casino bonus offers and choose your favorite.

The degree of your own nontaxable handle spend will likely be revealed in the package a dozen away from Setting(s) W-2 having code Q. If you are processing a mutual return and you may you and your wife acquired nontaxable handle spend, you could potentially for each create your very own election. To put it differently, if a person people helps make the election, the other it’s possible to in addition to enable it to be but does not have any in order to. Enter into any estimated government income tax repayments you have made to have 2024.

You may need to shell out a supplementary taxation for many who acquired an excellent taxable delivery from a healthcare checking account. If you are in addition to alimony money out of more than one breakup otherwise breakup agreement on the earnings, enter the full of all alimony acquired on the internet 2a. The newest Irs try invested in providing taxpayers that have limited-English proficiency (LEP) by providing OPI characteristics.